Projects

Pre-Feasibility Study (PFS)

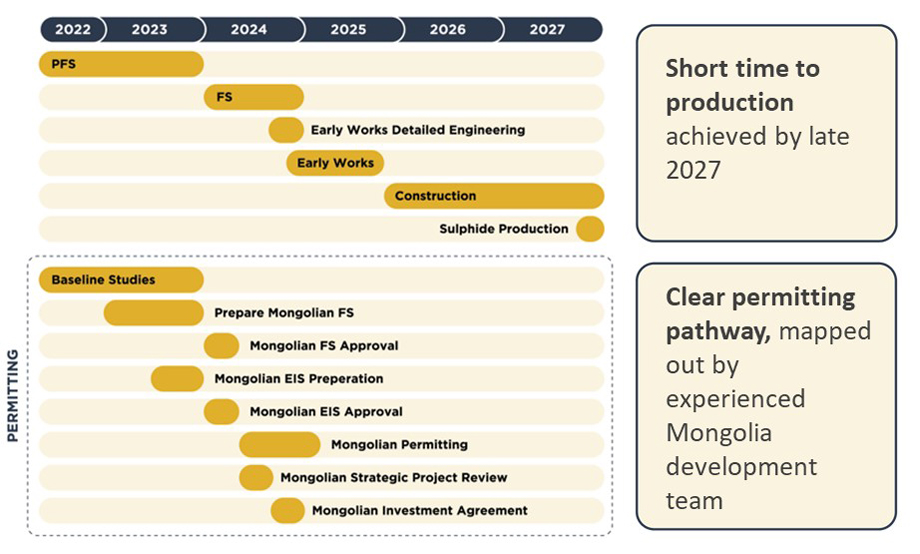

A Pre-Feasibility Study (Kharmagtai PFS) and discovery exploration commenced at Kharmagtai in early 20231. The Kharmagtai PFS will evaluate growth-focused opportunities in mining & processing technologies and higher-grade focused discovery exploration, aimed at materially upgrading the base case Scoping Study1.

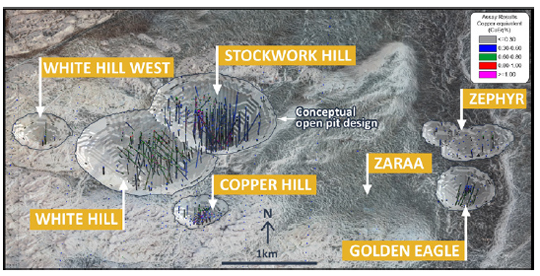

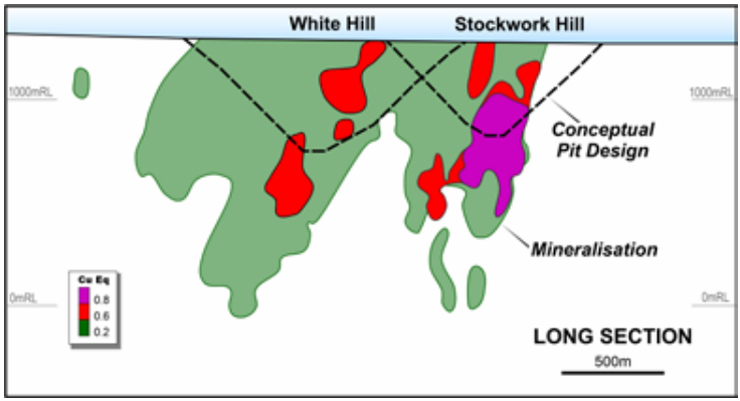

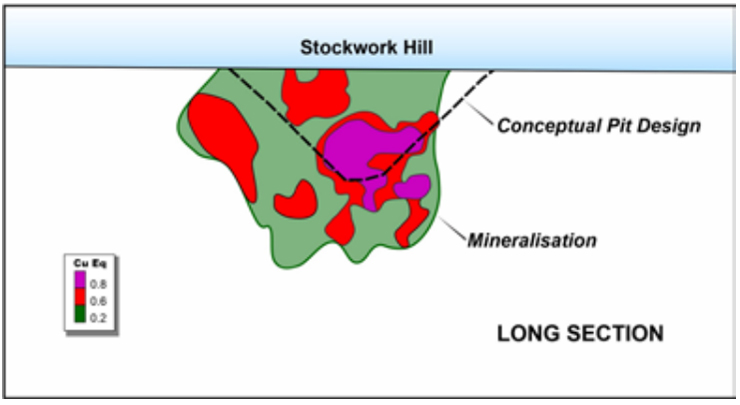

The initial drill program is comprised of ~30,000-meteres of diamond drilling with four rigs onsite1. A key objective of the drilling program is to upgrade the current open-pit Mineral Resource areas and inform geometallurgical and geotechnical models needed to complete the Kharmagtai PFS and support delivery of a Maiden Ore Resource Estimate. An updated MRE is on-track for delivery in Q4 CY2023.

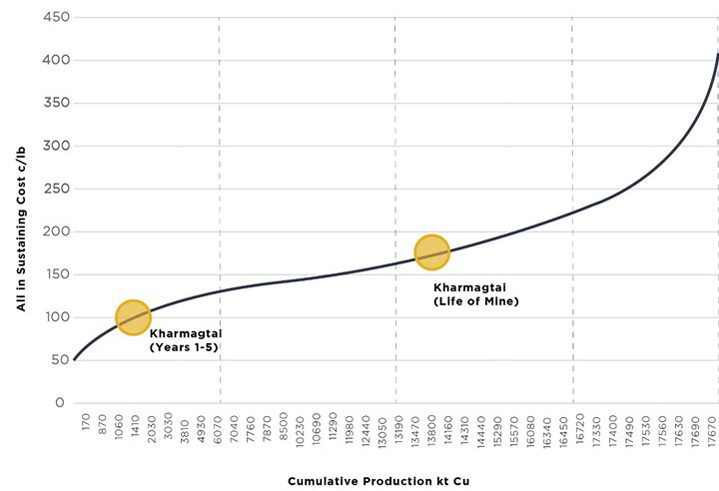

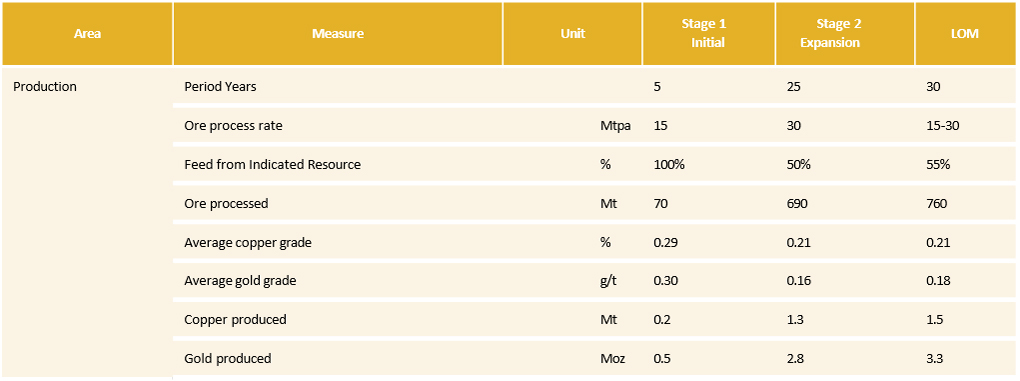

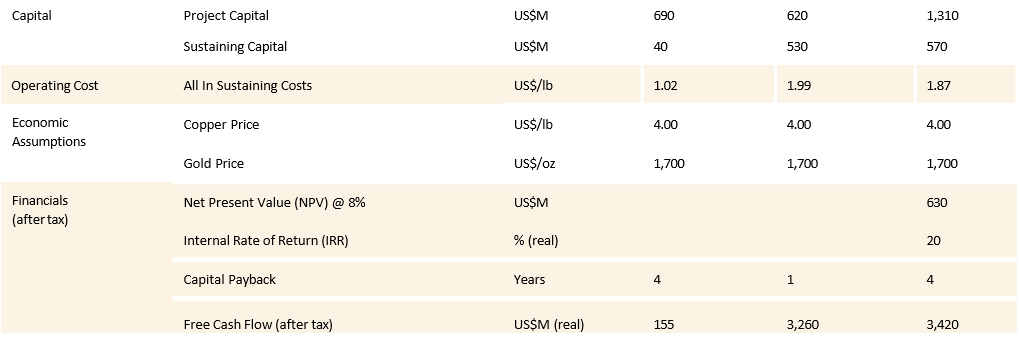

The 2022 PEA and Scoping Study was published for Kharmagtai in April 20223. This confirmed Kharmagtai’s potential to be a world class, low cost, long life copper-gold mine. The Study estimated 20% IRR (range 16-25%), US$630M NPV @ 8% (range US$405-850M), and four year payback (range 4-7 years) over a 30 year mine life. Annual production averages 50ktpa copper and 110kozpa gold over the Life of Mine (LOM) at all-in sustaining cost of US$1.87/lb.

Over the first five years, annualised production averages 37ktpa copper and 110kozpa gold, at first quartile all-in sustaining cost of US$1.02/lb Cu.

Scoping Study Results

Xanadu’s Position on the Cost Curve

Key assumptions, data sources and data reliability/quality information relating to this resource can be found in the Kharmagtai Technical report lodged on SEDAR, dated 20 June 2022.

References:

- ASX/TSX Announcement 13 April 2023 – Kharmagtai Pre-Feasibility drilling off to a flying start

- ASX/TSX Announcement 7 June 2023 – New Higher Grade Zones Found in Kharmagtai Infill Drilling

- ASX/TSX Announcement 6 April 2022 – Scoping Study – Kharmagtai Copper-Gold Project